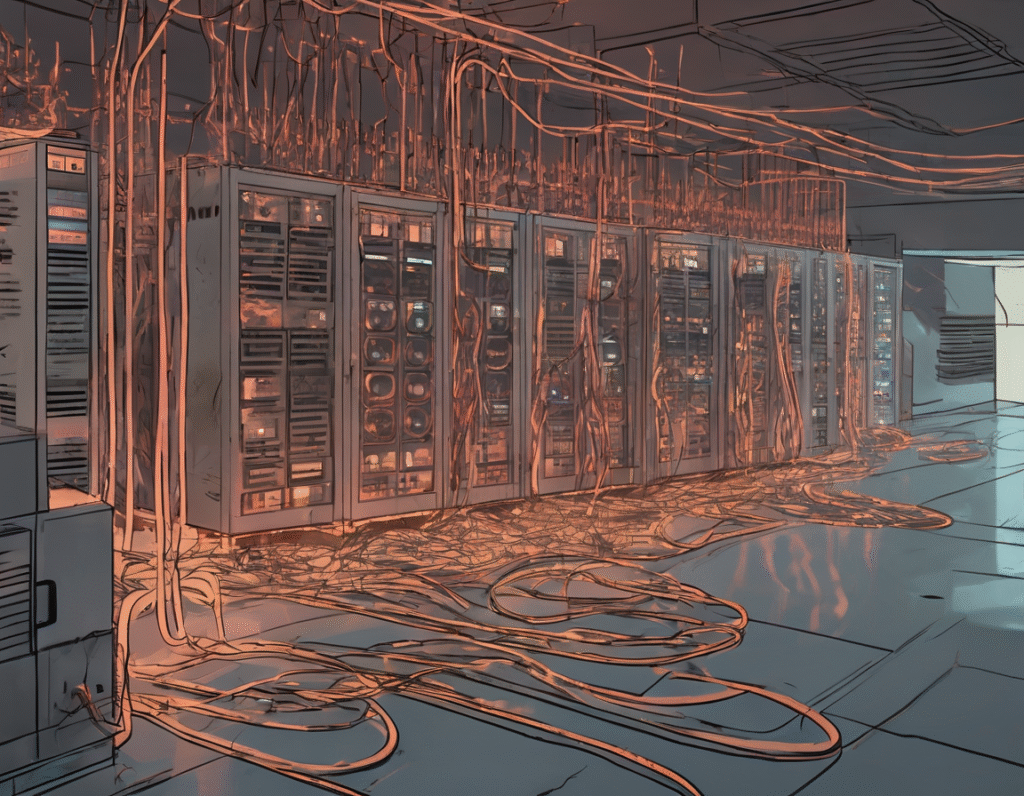

The staggering cost of the artificial intelligence arms race is beginning to show its first cracks, with reports emerging that even the largest tech companies are facing unprecedented financial strain as they scramble to build and power the necessary infrastructure. Industry insiders describe expenditure levels that are entirely outside historical norms, with one source noting the numbers are unlike anything seen in twenty-five years in the business. This immense pressure stems from a simple but brutal economic reality: building and running advanced AI is extraordinarily expensive. The primary costs come from two fronts. First, there is the acquisition of specialized AI chips, primarily high-end GPUs from companies like Nvidia. These processors are the engines of the AI boom, and demand has far outstripped supply, creating a seller’s market with sky-high prices. To train a leading frontier model can require tens of thousands of these chips, representing a capital investment of billions before a single query is processed. Second, and perhaps more crippling in the long term, is the operational cost of running these systems. The electricity required to power vast data centers filled with these energy-hungry chips is monumental. Furthermore, the physical infrastructure for cooling these facilities adds another layer of cost. The total compute and energy bill for training and, more significantly, for inferencing—actually using the models to generate answers for users—is creating a financial burn rate that is unsustainable for many. The situation is creating a clear divide. The hyperscalers—tech giants with massive, established cloud businesses—are somewhat better positioned, as they can leverage their existing scale and customer bases. However, they are still engaged in a ferocious capital expenditure war, spending hundreds of billions collectively to expand their AI data centers. For smaller players and well-funded startups, the path is far more treacherous. They must secure chips at premium prices and face daunting operational costs without a comparable revenue stream to offset them. This has led to a scramble for financing and a reevaluation of business models. Companies are being forced to seek ever-larger funding rounds just to cover infrastructure, not development. The classic Silicon Valley growth-at-all-costs playbook is being tested by physics and power grids. The promise of future AI revenue is now colliding with the present-day reality of multi-million dollar monthly electricity bills. For the cryptocurrency and blockchain community, this unfolding scenario presents a stark contrast and a potential opportunity. The crypto industry has long grappled with critiques over energy consumption, particularly proof-of-work networks. Yet, the AI sector’s energy demands are on a trajectory to dwarf those of major cryptocurrencies like Bitcoin. This parallel is likely to reignite debates about energy use and the valuation of compute-intensive technologies. More strategically, the AI infrastructure crisis underscores the fundamental value proposition of decentralized compute networks. Projects aiming to create global markets for GPU power or distributed compute resources could find a powerful new use case. If centralized tech companies are buckling under the cost and logistical burden of AI infrastructure, a peer-to-peer model for renting and sharing compute could become a viable alternative, potentially offering cost efficiency and resilience. The current distress in traditional tech may very well act as a catalyst for the adoption of decentralized physical infrastructure networks, merging the needs of AI with the principles of crypto-economics. The ultimate question is whether the current AI business models can generate enough revenue to justify the astronomical infrastructure spend. If not, the industry may face a significant correction, a wave of consolidation, or a pivot toward more hybrid and decentralized approaches to managing the world’s most expensive compute cycle.