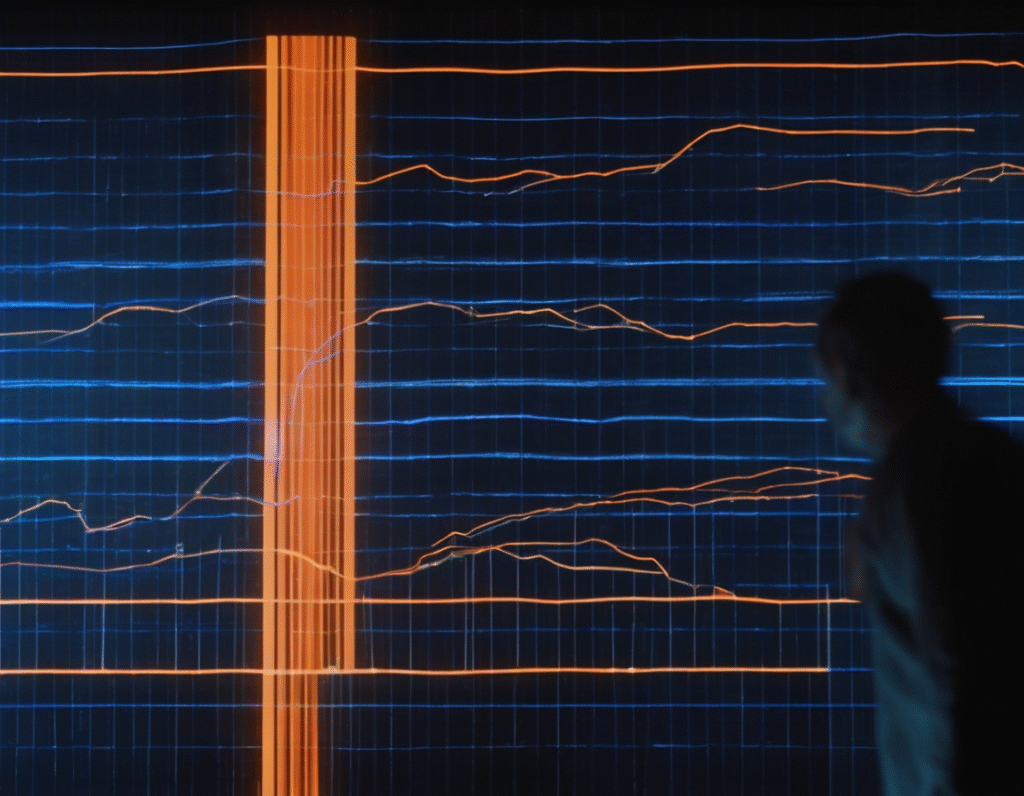

Bitcoin Nears Critical Long Term Support as Traders Watch for Price Floor Bitcoin is currently testing a key long term technical level that market participants are closely monitoring. The asset is approaching its 200 week moving average, a trend line historically viewed as a major support zone during bull market corrections. Analysts suggest this area could be instrumental in establishing a potential floor for BTC price. The 200 week moving average is a widely watched metric, calculated by averaging the closing price of Bitcoin over the last two hundred weeks. It smooths out short term volatility to reveal the underlying long term trend. Throughout Bitcoin’s history, pullbacks to or slightly below this line have often presented significant buying opportunities and marked the end of prolonged downtrends, preceding substantial rallies. Market observers note that while Bitcoin has dipped below this level during the depths of bear markets, such as the period following the FTX collapse, holding above it during corrections within a broader uptrend is typically a bullish sign. The current approach to this moving average comes after a period of consolidation and downward pressure, leading traders to question whether this historical support will hold once again. The significance of this level is psychological as much as it is technical. It represents a line in the sand for many long term investors and institutional entities. A decisive and sustained break below it could signal a deeper market correction and a shift in sentiment. Conversely, a strong bounce from this zone would reinforce the narrative of a resilient bull market and could restore trader confidence. Several factors are contributing to the current market tension. Macroeconomic uncertainty, including shifting expectations around interest rates and geopolitical instability, continues to influence all risk assets, including cryptocurrencies. Additionally, flows into and out of major spot Bitcoin exchange traded funds are being scrutinized daily for clues about institutional demand. Traders are advising caution, noting that while the 200 week moving average is a critical area, it is not an infallible indicator. They emphasize the importance of observing price action and trading volume around this level. A bounce on high volume would be a stronger signal than a weak, low volume consolidation. The coming weeks are likely to be crucial for determining Bitcoin’s medium term trajectory. If the support holds and Bitcoin stabilizes, it could set the stage for the next leg upward, with traders looking for a reclaim of higher price levels. A failure to hold, however, may see the market search for support at lower levels, potentially extending the current correction phase. For now, the focus remains squarely on this long term trend line as a potential anchor for Bitcoin’s price discovery.