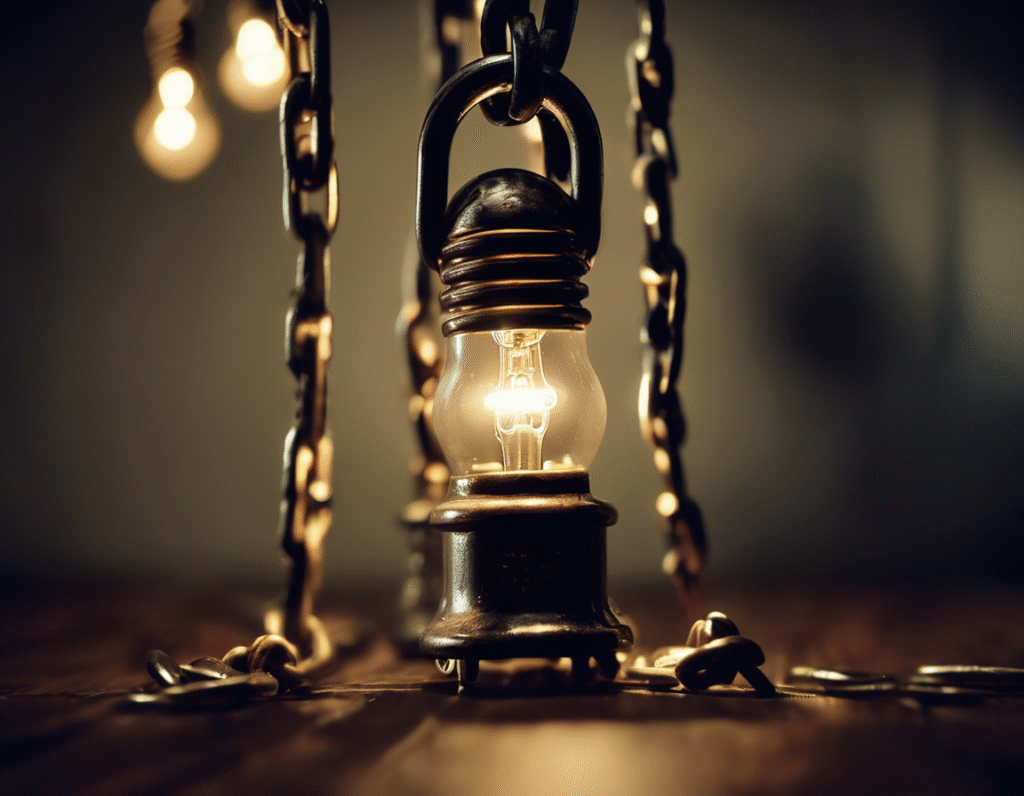

Tokenization Benefits Are a Glimmer Now But Could Shine With Democratization Says NYDIG Executive The immediate practical benefits of tokenizing real world assets like real estate or commodities may be limited at first, but the long term potential is vast if the technology becomes more accessible and regulatory frameworks adapt. This perspective comes from Greg Cipolaro, Global Head of Research at digital asset firm NYDIG. In a recent discussion, Cipolaro described the current state of real world asset tokenization as offering a light at first rather than a blinding beacon. The core idea involves converting rights to a physical asset into a digital token on a blockchain. This can make buying, selling, and trading fractions of traditionally illiquid assets like buildings or fine art more efficient. However, Cipolaro pointed out that for these tokenized assets to reach their full potential, especially within the decentralized finance ecosystem, significant regulatory evolution is required. Current financial regulations were not designed with programmable blockchain-based assets in mind, creating a compliance gap that hinders seamless integration. The promise of tokenization lies in democratizing access to investment opportunities. By dividing a high value asset into digital shares, it could allow a broader range of investors to participate in markets from which they were previously excluded due to high capital requirements. This could apply to commercial real estate, private equity, or other alternative assets. Yet, for this democratization to occur, the process must become simpler and more user friendly. Cipolaro suggested that the experience needs to be as straightforward as traditional online investing for mainstream adoption to take hold. Complex wallet setups and on chain interactions remain a barrier for the average person. Another area highlighted was the need for these tokenized assets to interact with DeFi protocols like lending platforms and decentralized exchanges. This interoperability could unlock new forms of collateralized borrowing and automated financial services built around real world assets. But again, this hinges on regulators providing clearer guidelines on how tokenized ownership is treated under the law. Cipolaro also touched on the current market drivers. Much of the present interest and investment in tokenization projects is coming from large traditional financial institutions exploring efficiency gains in settlement and custody. While valuable, this institutional focus is different from the vision of open, permissionless access that many in the crypto space envision. The path forward, according to this view, involves parallel development. Technology providers must continue building more intuitive platforms. Simultaneously, ongoing dialogue between the industry and policymakers is crucial to develop regulations that protect investors without stifling innovation. The conclusion is that the journey of real world asset tokenization is still in its early stages. The immediate benefits may appear incremental, primarily improving back office processes for big players. But the foundational work being done now could eventually support a much more open and inclusive financial system, if the challenges of regulation and user experience are adequately addressed. The light is visible, but it will take time and effort to make it shine for everyone.